|

|

|

|

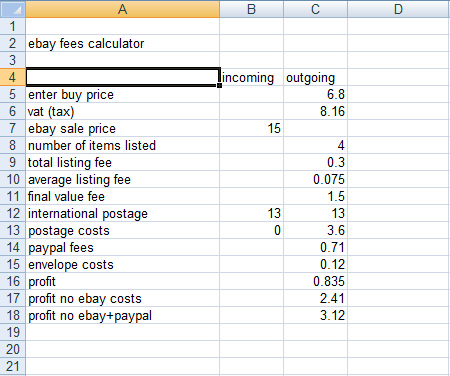

Ebay Fees Calculator

If you sell physical goods then using Ebay is a great way to market your website. You can also use it to get rid of goods you cannot shift.

The trouble with selling things on Ebay is that it isn't obvious all the time how much money you are making on each item you sell - assuming you are making any money at all.

We have included a free ebay calculator spreadsheet with this article.

It's worthwhile just explaining how this spreadsheet works:

- In cell C5 is the cost of purchasing whatever it is you are selling.

- C6 is the cost of the item plus any tax on it - if there is no tax then you will need to change the formula from =C2*1.2 to =C2*1

- B7 is your experimental sale price on ebay

- C8 is the number of items you are listing on the site - the more you list (assuming you sell them all the higher profit you will make

- C9 is the total listing fee - this can change depending on if Ebay are running any special promotions or you own an Ebay shop plus a few other reasons.

- C11 is the final value fee - this can change depending on the type of product you are selling and whether you are registered on ebay as a private seller or a business seller - we have put it down as 10% for now - we have used the formula =0.1*B7, change 0.1 to whatever percentage you require it to be - e.g 5% would be 0.05.

- Postage costs are what you are charging the customer in B13 and the actual cost it is to you in C13.Previously Ebay didn't charge 10% of the postage costs - but they have changed this and now charge you a final value fee on the postage - which is a complete rip off! So the best thing to do now is to actually offer free postage on everything (but obviously build in the postage costs into your item costs) - the extra reason for doing this is if an international person buys and you charge them a lot for postage which is usually the case - Ebay won't actually put a final value fee on the international postage (because they know it could be very high for items).

- C14 is the paypal fees as most of the time you will be paid this way. We've put the fees at 3.4%+0.20 fixed fee. If you take more money through Paypal each month then this fee can come down.

- C15 is your envelope costs - This is the cost of each envelope you send the goods in. Large boxes can cost quite a lot and reduce your bottom line so it's advisable to buy in bulk - don't forget to include bubble wrap, cellotape into the price.

- C16 is your profit.

- C17 is your profit if you weren't selling the item on Ebay and just had the Paypal fees.

- And C18 is your profit if you had no Ebay or Paypal fees - i.e. you are running a website where somebody might just pay into your bank account.

Remember if you have to drop parcels off and need a car then you are using wear and tear and fuel to get there and back so you need to build this into your calculations. If you are dropping parcels off while walking the dog - then effectively it's not costing you anything to drop them off. We advise you to not drop parcels off everyday as you are making more trips than necessary. Also if you can have an arrangement with your post office where you can just drop your parcels off then you will save yourself a whole heap of time.